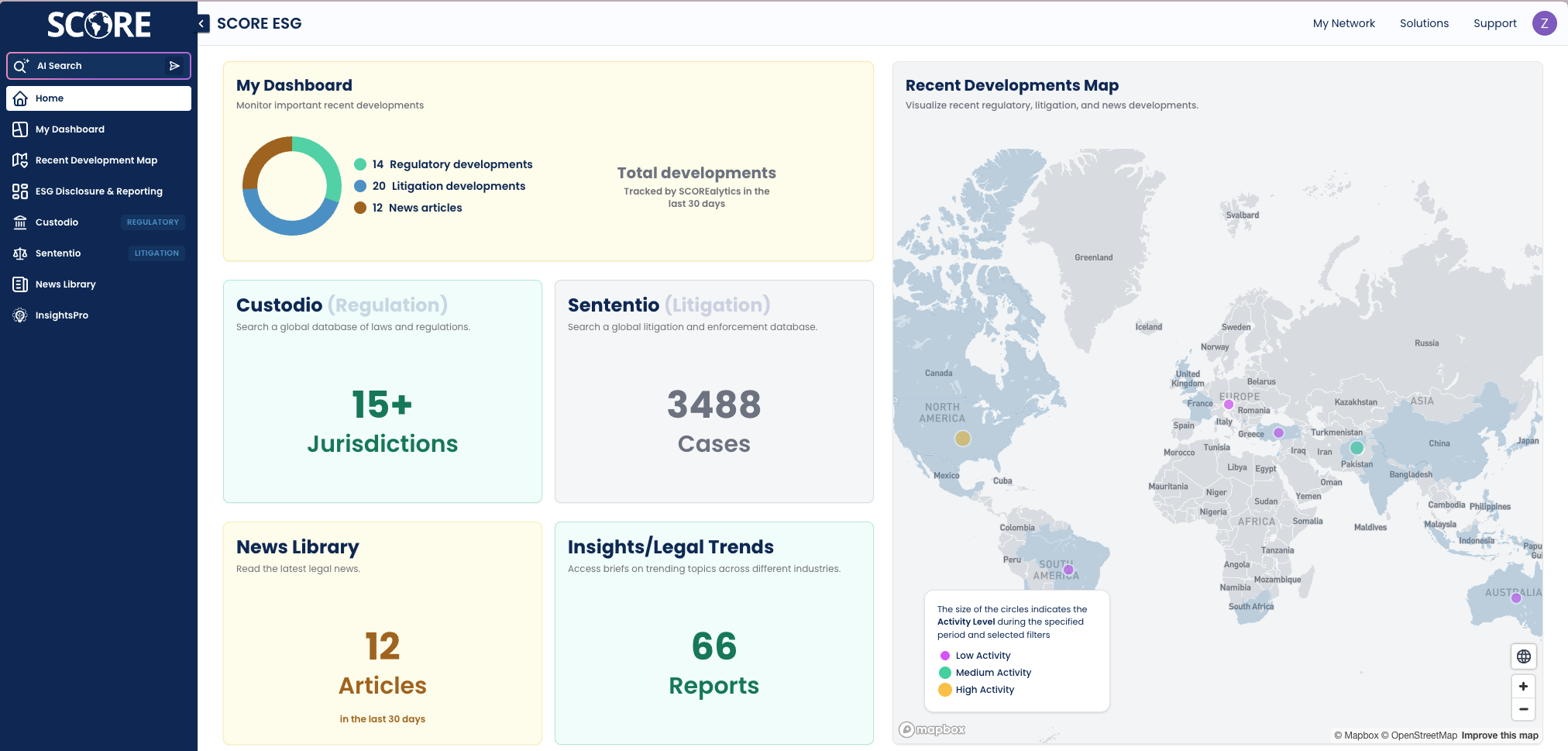

Intelligence tailored to how you operate

SCORE delivers regulatory foresight customised for corporates, investors, and legal advisors—so every stakeholder gets the insight they need, in the format they use.

Request DemoTurn regulatory complexity into strategic advantage

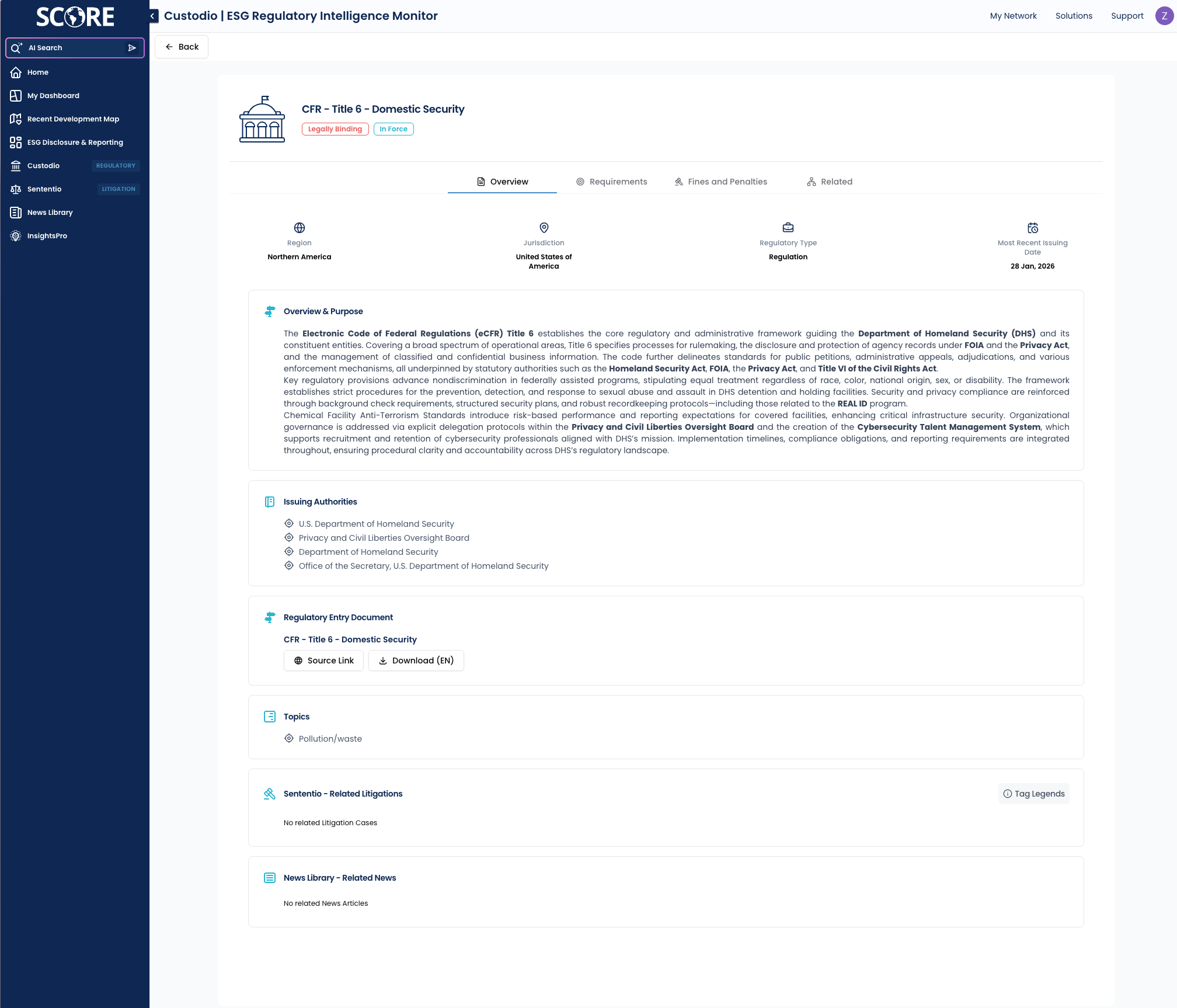

SCORE helps corporations doing business internationally anticipate regulatory shifts, reduce fragmented monitoring, support capital deployment, and strengthen board‑level governance.

Value Drivers

Anticipate regulatory shifts early enough to adapt strategy and operations.

Reduce fragmented, duplicative monitoring across regions and business units.

Strengthen oversight and investor communication on ESG and legal risk.

Improve capital‑allocation decisions using quantified regulatory complexity and enforcement trajectories.

Build regulatory foresight into every deal

Value Drivers

Faster investment decisions

Surface regulatory and litigation trends by sector and jurisdiction.

Smarter use of counsel

Focus external counsel on the highest‑impact issues, not broad open‑ended research.

Portfolio value protection

Continuously monitor shifting rules that could affect portfolio value.

Stronger LP narrative

Demonstrate systematic monitoring of legal and regulatory risk across funds.

Workflow Comparisons

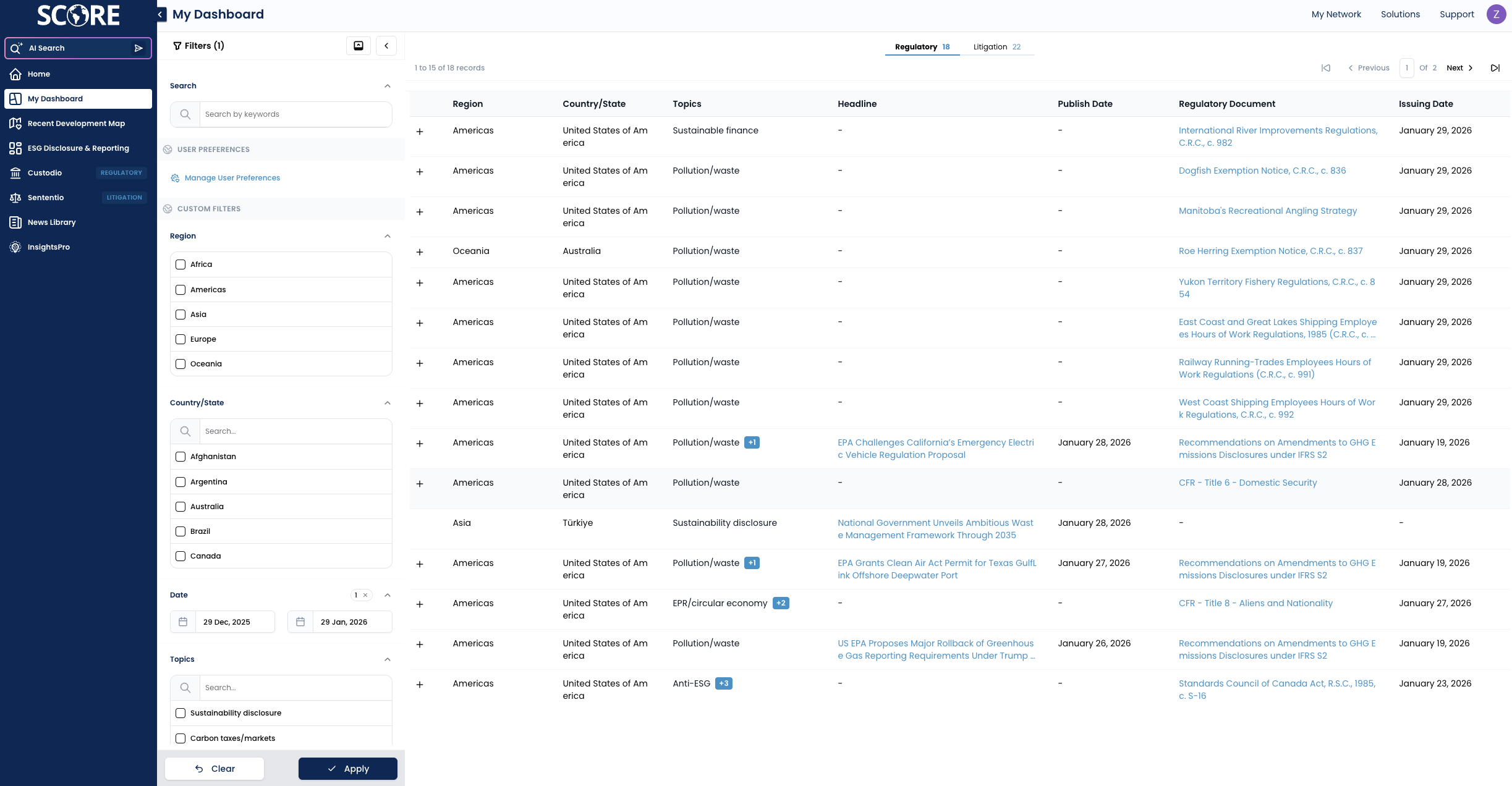

Diligence Research

Current State

Ad‑hoc research driven largely by external counsel; varying depth and structure by deal.

With SCOREalytics

Standardized SCORE scans give internal teams and counsel a consistent, structured view by sector/jurisdiction.

Portfolio Risk Review

Current State

Generic compliance updates in board packs; limited comparability across investments.

With SCOREalytics

Fund‑level dashboards and risk indicators (coming soon) dropped into portfolio reviews and board materials.

LP Reporting

Current State

Qualitative ESG/compliance narrative with limited evidence.

With SCOREalytics

Proactive, comprehensive, technology-driven approach referenced in DDQs, AGMs, and stewardship reports.

Exit Readiness

Current State

Late‑stage surprises during buyer diligence; reactive remediation.

With SCOREalytics

12–24‑month pre‑exit scans and disclosure testing against evolving rules.

| Workflow | Current State | With SCOREalytics |

|---|---|---|

| Diligence Research | Ad‑hoc research driven largely by external counsel; varying depth and structure by deal. | Standardized SCORE scans give internal teams and counsel a consistent, structured view by sector/jurisdiction. |

| Portfolio Risk Review | Generic compliance updates in board packs; limited comparability across investments. | Fund‑level dashboards and risk indicators (coming soon) dropped into portfolio reviews and board materials. |

| LP Reporting | Qualitative ESG/compliance narrative with limited evidence. | Proactive, comprehensive, technology-driven approach referenced in DDQs, AGMs, and stewardship reports. |

| Exit Readiness | Late‑stage surprises during buyer diligence; reactive remediation. | 12–24‑month pre‑exit scans and disclosure testing against evolving rules. |

Scale cross‑border insight. Deepen client collaboration

SCORE helps global law firms deliver stronger cross‑border coverage, deepen collaboration with clients, stand out as innovators, and enhance engagement profitability.

Value Drivers

Stronger cross‑border coverage and insight.

Deeper, ongoing collaboration with clients.

Enhanced brand as an innovation leader.

Enhanced engagement profitability.